Walking with cash, even small volumes, is a life threatening risk. In Rwanda, however, the case is different. There is so much security in Rwanda that people easily abuse it.

You will see people walking out of a bank with huge sums of cash, swinging heavy envelopes across the street, unharmed and unthreatened. Others carry bags full of money unescorted to the bank.

This, many observers say, is an advantage by all standards, but it is also a ‘moral hazard’. It has become one of the ‘invisible’ obstacles affecting Rwanda’s efforts of creating a cashless economy.

For many economies across Africa, Mobile Money platforms have been adopted quicker than in Rwanda because, societies in these economies are not secure.

“In Rwanda, security is not a problem, and we cannot drive the adoption of non-cash payment systems by [presenting] a security issue of the physical cash as case,” says Maurice Toroitich, Managing Director of KCB Bank Rwanda.

Toroitch suggests that, “…perhaps what we should be talking about is the security around the systems that we have and actually taking advantage of the secure environment that we [Rwanda] have to make a quantum step in making people to understand that you don’t deal in cash not because it is safe to carry.”

Cash accounts for about 85% of global consumer transactions. Much of the world’s population is now acquiring access to a multitude of non-cash options for making payments.

Economists define a cashless society as a system where financial transactions are not conducted with money in the form of physical banknotes or coins, but rather through the transfer of digital information (usually an electronic representation of money) between the transacting parties.

It is believed that the burden of cash usage on national economies is substantial, representing close to 1.5% of GDP.

Rwanda is pushing for a cashless economy. The economy is on an upward trajectory with an average of 7.5% GDP growth over the past decade. The services industry has overtaken agriculture as the main earner and technology is now key growth component.

Finance Minister Clever Gatete told the BBC last year that technology “is affecting everything.” “It is helping in how we collect taxes, it is helping the banking system in how they function – it is helping almost every sector of the economy.”

At the moment, cashless systems have contributed 3% to the country’s GDP growth.

According to the Central Bank of Rwanda, between December 2015 and December 2016, the number of ATMs in Rwanda increased by 5% from 380 to 400 while the number of Point Of Sales (POS) devices increased by 10% from 1,718 to 1,885 due to increased demand from merchants like new hotels.

The number of ATM cards increased by 14% from 661,389 in December 2015 to 754,384 in December 2016.

Meanwhile, the number of transactions on ATMs and POSs increased by 9% from 7,505,815 to 8,183,116 in volume and by 15% from Rwf354 billion to Rwf406 billion in value while POS transactions increased by 77% from 373,029 to 660,746 in terms of volume and 56% from Rwf26.6 billion to Rwf41.5 billion in terms of value.

Mobile technologies are playing a big role to enhance electronic payments and increasing financial inclusive to a cashless society. There are 3.4 million active mobile money holders and 60,000 agents so far, according to the Central Bank.

Registered mobile money accounts have increased by 27% to 9.7 million with over Rwf1 billion transactions by December 2016. The largest volume is transacted through sending or receiving money between persons.

Cross border mobile money transfers are joining approximately one million mobile banking users and 44,000 internet banking users especially for government payments, thanks to the Rwanda Online Project Rwandans are now able to pay for government services.

These platforms have seen government collect Rwf1.36 billion in 2016 from Rwf230 million in 2015.

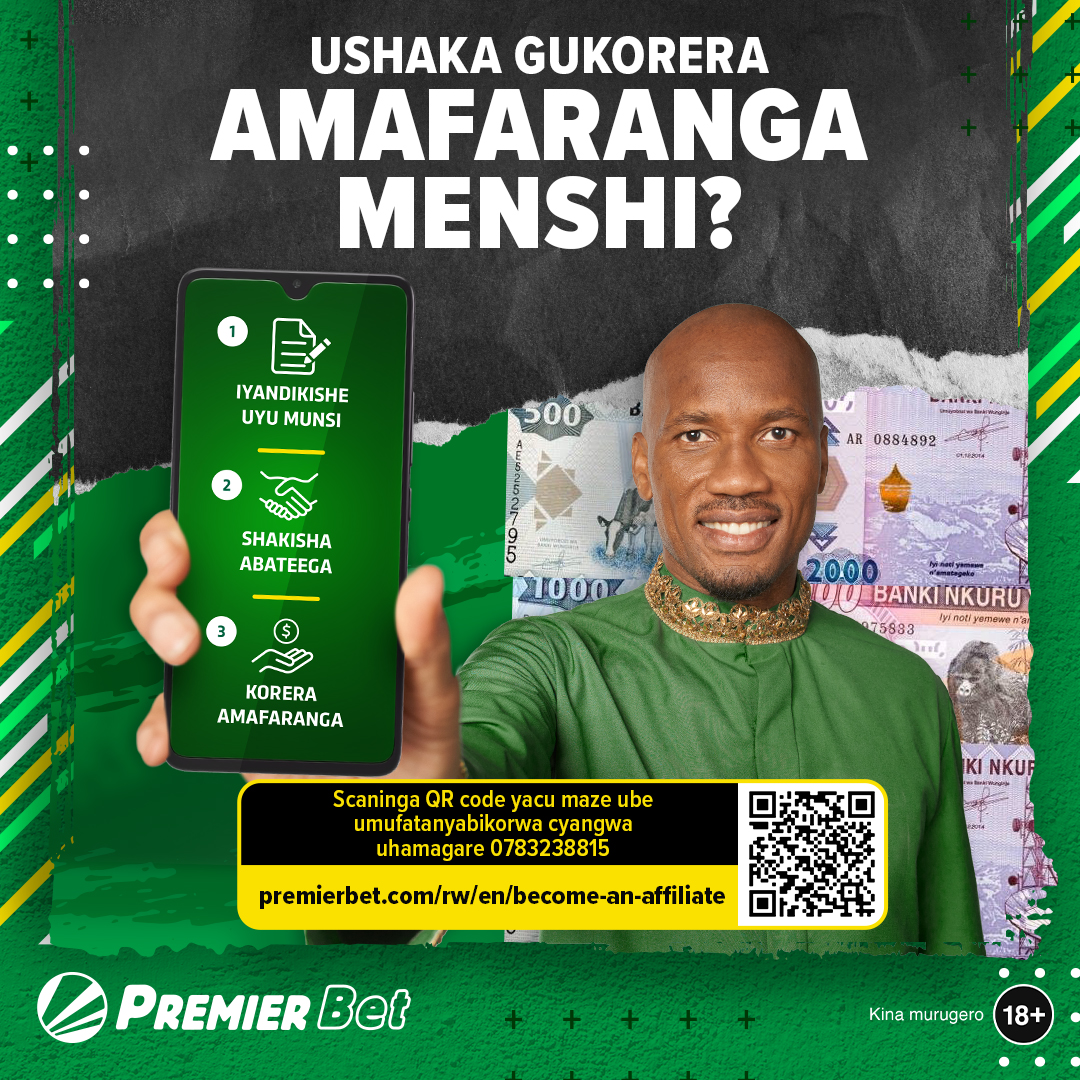

On the side of the private sector, the case is being escalated to a whole new level.

KCB Bank is one of the institutions pushing this cashless effort. On top of products promoting electronic transactions, the bank is engaging expert discussion on the best way to achieve this vision. Antoine Muhire, Founder and CEO of Mergims was invited to a debate organised by KCB to speak about his experiences in the FinTech (financial technology) industry.

“We have internet and that is a great advantage and I feel like it is not used enough. The second is that we have smartphones; those things…once people start understanding that the smartphone they have in their hands is more than just for WhatsApp and making calls; that it is a very smart tool, platforms such as MERGIMS will revolutionalise our economy,” says Antoine Muhire.

“We have internet and that is a great advantage and I feel like it is not used enough. The second is that we have smartphones; those things…once people start understanding that the smartphone they have in their hands is more than just for WhatsApp and making calls; that it is a very smart tool, platforms such as MERGIMS will revolutionalise our economy,” says Antoine Muhire.

Lucy Mbabazi, Country Director for VISA Card spoke about the benefits of cashless economy, but also what the banks need to do in the first place. “To be able to pay and transact cashless, one has to have a bank account…cashless banking is a catalyst for the financial inclusion, the more Rwandans and businesses are going to pay cashless, the more we shall truly achieve the financial inclusion,” says Mbabazi.

Lucy Mbabazi, Country Director for VISA Card spoke about the benefits of cashless economy, but also what the banks need to do in the first place. “To be able to pay and transact cashless, one has to have a bank account…cashless banking is a catalyst for the financial inclusion, the more Rwandans and businesses are going to pay cashless, the more we shall truly achieve the financial inclusion,” says Mbabazi.

Photos & Video by PACIFIC HIMBAZA & NICOLAS KIZZA

In this video below, Taarifa’s Chief Editor, Magnus Mazimpaka, engages these experts.