Prime Energy Plc (“Prime Energy”), a leading renewable energy independent power producer in Rwanda, received a groundbreaking approval from the Capital Market Authority on 1st March 2024 to issue the country’s inaugural Green Bond.

This milestone greenlight from the regulatory body empowers Prime Energy to advance toward issuing the green bond, offering it to the public, and subsequently listing it on the Rwanda Stock Exchange.

The Green Bond boasts a face value of FRw 9.5 billion (Nine billion and Five Hundred Million) and a tenor of 7 years.

The issuance aims to channel proceeds into both funding a new project and financing the maintenance of existing plants. The bond offer opens on March 18th, 2024, with a closing date set for April 5th, 2024. Following the closure, the Green Bond will debut on the Rwanda Stock Exchange on April 26th, 2024.

Externally verified as “Green Bonds” based on a Second Party Opinion (SPO), this issuance aligns with the core components of the updated International Capital Market Association (ICMA) Green, Social, and Sustainability Bond Principles issued in June 2021.

The International Finance Corporation (IFC), the private sector arm of the World Bank Group, played a pivotal role in supporting this transaction. Collaborating with Prime Energy, the IFC facilitated the structuring of the green bond and identified potential investors.

This support is part of a broader initiative aimed at facilitating access to long-term local currency finance in Rwanda for critical sectors.

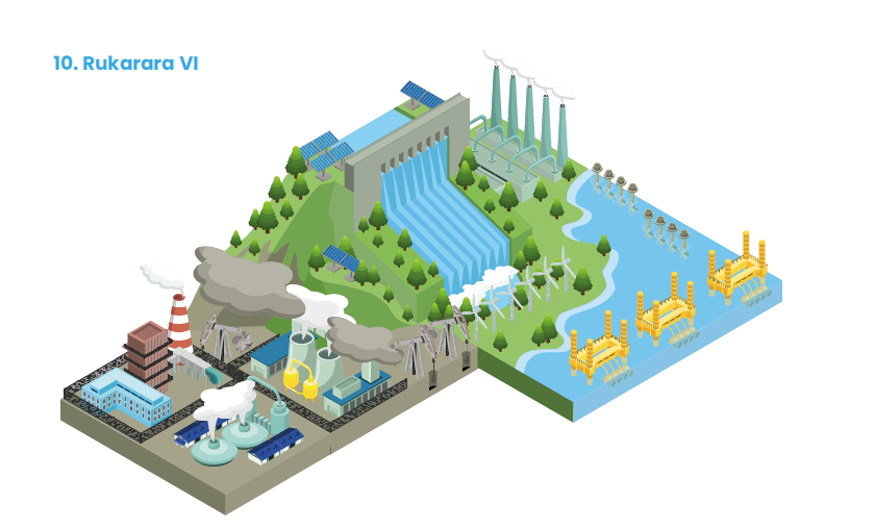

Prime Energy operates four hydropower plants across Rwanda, with 25-year concession agreements with the Government of Rwanda and power purchase agreements (PPAs) with Energy Utility Corporation Limited (EUCL).

Sandy Rusera, CEO of Prime Energy, expressed enthusiasm, stating, “Securing approval for the first-ever green bond in the country provides us with alternative options of financing through capital markets.

The proceeds from this issuance will allow us to accelerate our mission – providing reliable, clean power. We’re excited to use this type of instrument to increase our hydropower capacity and explore new opportunities to bring sustainable energy to more communities.”

Joe Nsano, COO of Prime Energy, emphasized the significance of this milestone, highlighting the benefits for both the company and environmentally conscious investors.

He noted, “This green bond issuance will be a significant financial achievement for Prime Energy, showcasing the strength of our business model and our commitment to responsible growth. The proceeds will enable us to invest in a new project, ensuring long-term financial sustainability.

Furthermore, this innovative financing tool allows us to directly connect with investors who share our vision for a greener future. This is a win-win for both Prime Energy and for environmentally conscious investors.”

The issuance of Rwanda’s first green bond by Prime Energy could serve as a catalyst for other companies in the market, inspiring them to explore alternative and innovative financing options.

Eric Bundugu, Executive Director of Rwanda Capital Market Authority, praised the approval, stating that, “This green bond marks another milestone on diversification of asset classes while deepening further the Rwandan capital market. This landmark achievement reflects a significant step forward in ensuring our domestic capital market continues to support Rwanda’s commitment towards sustainable finance development.”

Prime Energy’s pioneering move not only underscores its dedication to sustainable practices but also signifies Rwanda’s commitment to fostering green investments and building a resilient economy for the future.

BK Capital and AIS Capital advisors are the handlers of the issuance.