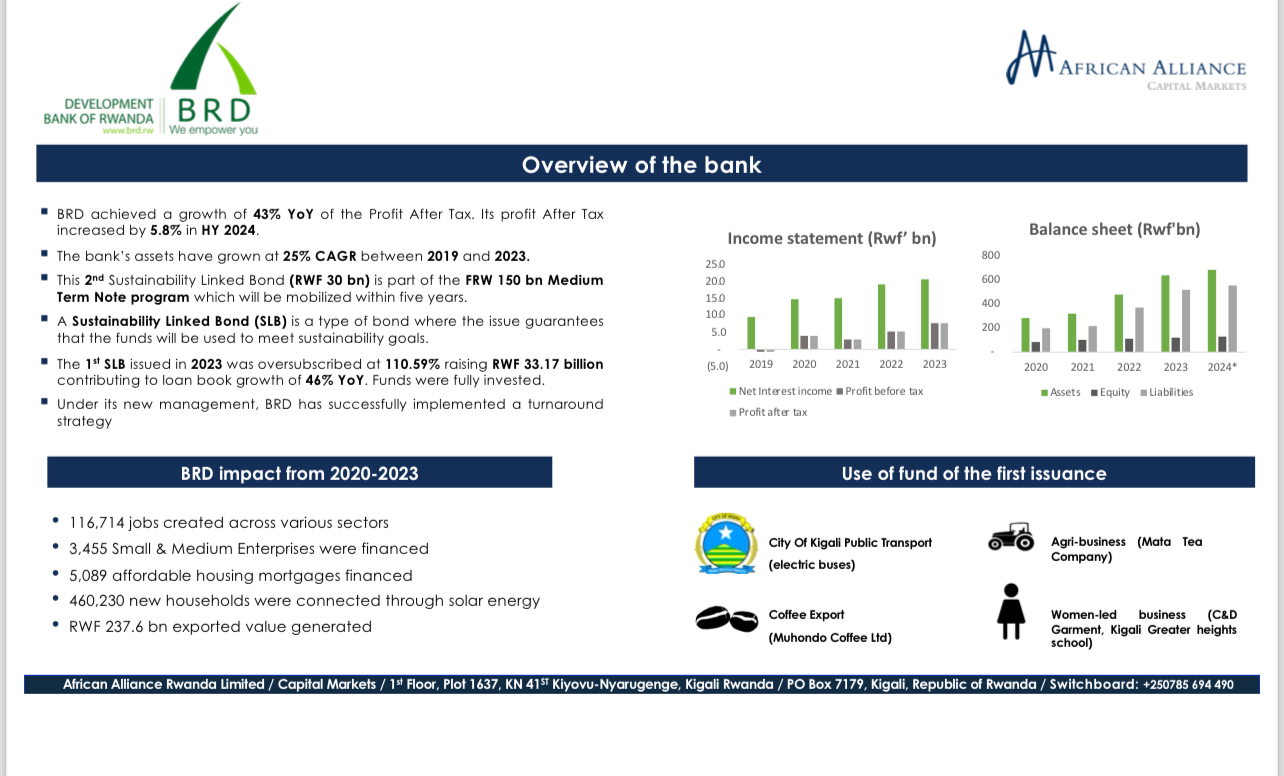

The Development Bank of Rwanda (BRD) has launched the second issuance of its Sustainability-Linked Bond (SLB), marking a significant step in its Medium-Term Note program, which aims to raise Rwf150 billion over five years.

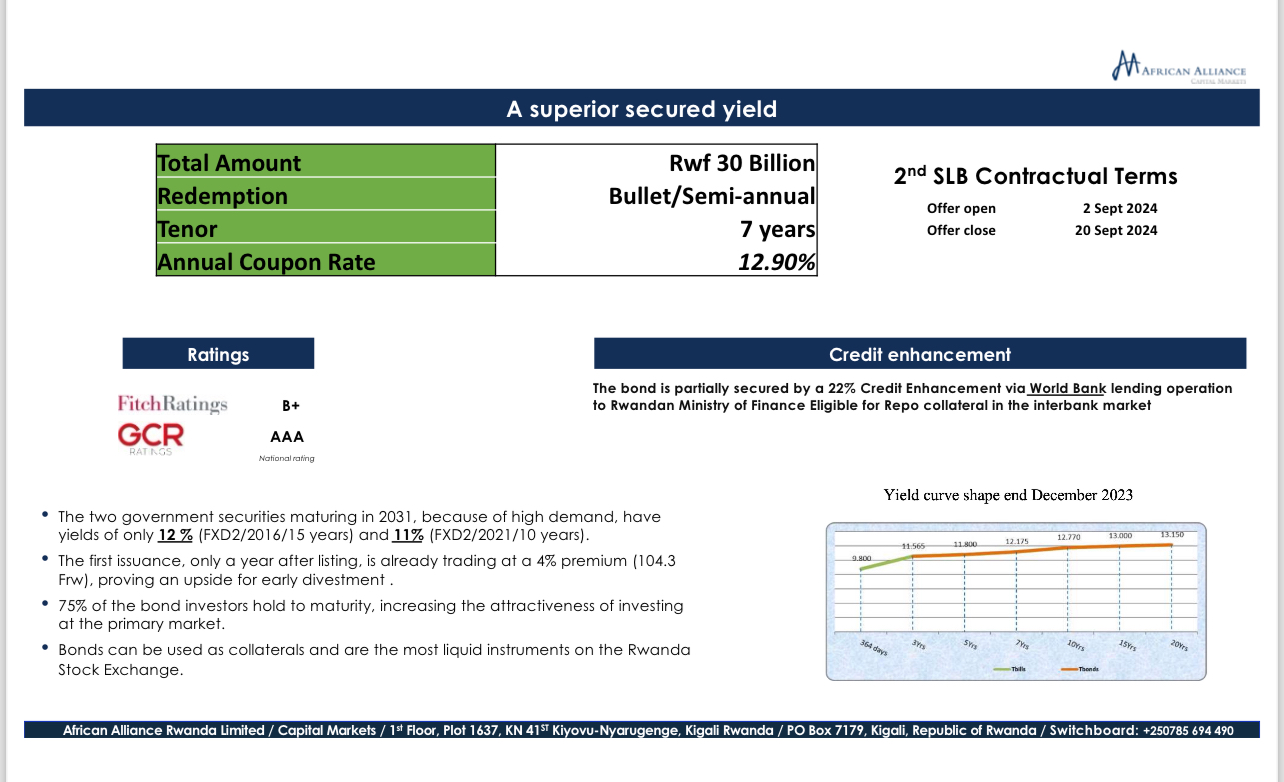

The latest bond, set to raise Rwf30 billion, is part of BRD’s broader mission to fund sustainable development projects in Rwanda.

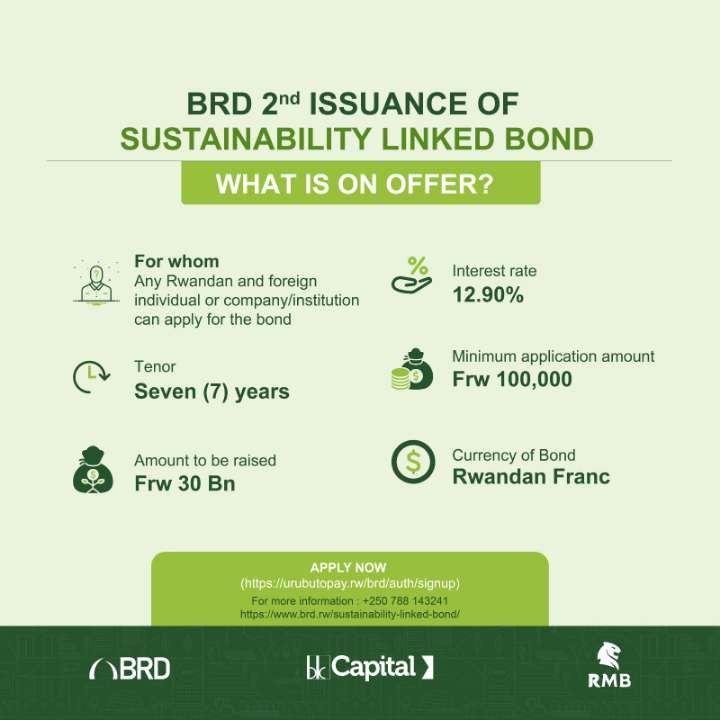

BRD CEO Kampeta Sayinzoga Pitchette explained that this bond is particularly accessible to retail investors, offering an interest rate of 12.90% over a seven-year term, with a minimum application amount of Rwf100,000.

The bond is available to both Rwandan and foreign individuals and institutions, aligning with BRD’s strategy to attract broader participation in Rwanda’s financial markets.

A standout feature of this issuance is the use of a fully digital platform for bond purchases, a first in Rwanda.

The new platform was developed by BK Capital and is being used for the first time in BRD’s bond issuance. Kampeta clarified that while BRD partnered with BK Capital to utilize the platform for this issuance, the platform legally belongs to BK Capital.

“We just partnered with them to make sure that it is available for our bond issuance. But BK Capital will continue using it for future bonds and other instruments they sell as brokers,” she said.

The platform represents a major step toward making the bond market more accessible, especially for retail investors.

It simplifies the investment process and aligns with both institutions’ commitment to financial inclusion. Kampeta emphasized that the platform is key to attracting more participation from individual investors, both Rwandan and foreign, who have traditionally been underrepresented in Rwanda’s bond market.

Reflecting on the performance of BRD’s previous bond, Kampeta noted that it was met with strong demand from a wide range of investors, a positive indicator for the second issuance.

The earlier success affirmed the confidence in BRD’s financial instruments, bolstering its efforts to fund Rwanda’s long-term development goals.

The funds raised through this bond will be channeled toward sustainability-linked projects that align with Rwanda’s Vision 2050, focusing on inclusive growth and environmental sustainability. Kampeta underlined that the bond not only offers competitive returns but also provides investors with a chance to contribute to Rwanda’s future.

As BRD embarks on this latest initiative, the introduction of BK Capital’s digital platform signals a broader shift toward innovation and accessibility in Rwanda’s financial sector.

The platform is expected to streamline investments in bonds and other financial instruments, making it easier for a diverse range of investors to engage in Rwanda’s growing economy.

With BRD’s continued focus on sustainability and BK Capital’s leadership in developing accessible financial solutions, the partnership demonstrates the potential for Rwanda’s financial markets to expand and attract even more retail participation in the years to come.