As Chief Executive Officer Pitchette Kampeta concludes her contractual tenure at the Development Bank of Rwanda (BRD), the institution’s latest performance indicators point to one of the most consequential transformation phases in its history. The figures released under her leadership depict not just growth, but a structural repositioning of BRD as a central driver of Rwanda’s development financing ecosystem.

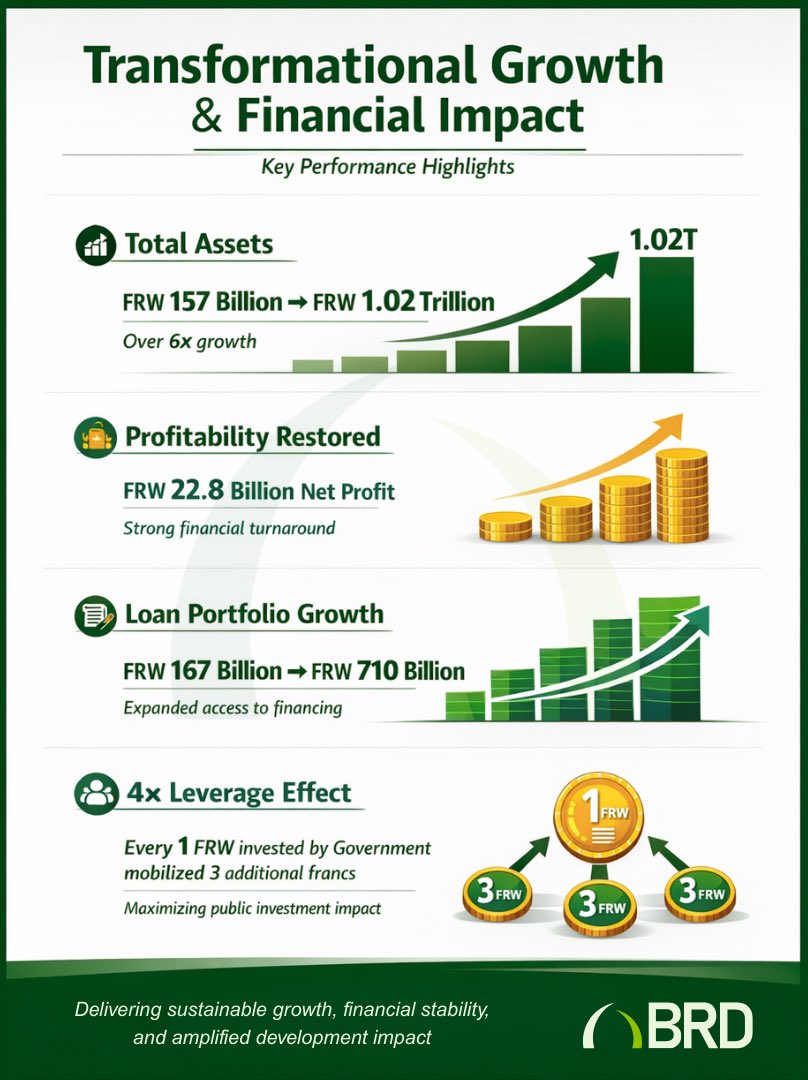

At the core of this transformation is a dramatic expansion of the bank’s asset base. BRD’s total assets grew from FRW 157 billion to FRW 1.02 trillion, representing more than a six-fold increase.

This scale of growth places BRD among the most rapidly expanding development finance institutions in the region and reflects a deliberate strategy to deepen balance sheet strength while expanding development reach.

Equally significant is the restoration of profitability. After years of constrained performance, BRD posted a net profit of FRW 22.8 billion, marking a decisive turnaround and signalling strengthened governance, improved risk management, and more disciplined capital allocation.

The return to profitability also enhances investor confidence and reinforces BRD’s credibility as a sustainable public financial institution rather than a purely policy-driven lender.

The loan portfolio expanded in tandem with the balance sheet. From FRW 167 billion, outstanding loans surged to FRW 710 billion, underscoring BRD’s growing role in financing productive sectors of the economy.

This growth reflects increased access to long-term financing for priority sectors, particularly infrastructure, agriculture, SMEs, and strategic industrial projects—areas often underserved by commercial banks.

Perhaps the most strategic outcome of Kampeta’s tenure is the demonstrated leverage effect achieved through public investment. The bank reports a 4x leverage ratio, meaning that every 1 franc invested by the government mobilized an additional 3 francs from partners and co-financiers. This multiplier effect signals effective crowding-in of private and development capital, transforming limited public resources into a far larger pool of investable funds.

Collectively, these figures suggest that BRD under Kampeta evolved from a traditional development lender into a catalytic financial institution capable of mobilizing capital at scale while maintaining financial sustainability. The emphasis on leverage, profitability, and balance-sheet growth indicates a strategic shift toward impact-driven finance rather than dependence on fiscal injections.

As she exits office, the numbers present a clear legacy: a stronger, more resilient BRD positioned to deliver long-term development impact.

The challenge for the next leadership phase will be sustaining this momentum—ensuring that scale, discipline, and development impact continue to advance in tandem.